Did you know that 88% of competitor data remains unused?

And only 27% of global performance marketers use them to refine their advertising strategies?

Even if these stats sound unbelievable, they are quite true.

When you're deep in performance marketing, understanding your competitors can be the secret weapon separating a profitable campaign from one that burns cash.

This is where competitive intelligence research comes into play.

For performance marketers at startups or founders managing campaigns themselves, there’s constant pressure to make every dollar work harder. Competitive intelligence (CI) research gives you an inside look at your competitors’ strategies: what offers they’re testing, which messages are hitting, where they’re investing, and where they’re leaving gaps.

Instead of guessing or reacting late, CI research empowers you to anticipate trends, spot openings, and act faster before your competitors realize what hit them.

In this guide, you’ll learn:

- What competitive intelligence research really means for performance marketers

- How to run a streamlined, powerful CI process without drowning in data

- How to apply intelligence to create smarter, faster, higher-converting paid media strategies

If you want to stop flying blind and start using your competitors’ moves to your advantage, you’re in the right place.

Time to get into the details.

What is competitive intelligence research?

At its core, competitive intelligence research is about collecting and analyzing information about your competitors to make smarter, faster, and more profitable marketing decisions.

In performance marketing, CI research focuses on uncovering exactly how your competitors are running their campaigns:

- What messaging they're pushing

- Which audiences they're targeting

- What offers they’re promoting

- Where they're spending budget and where they're pulling back

Competitive Intelligence research is all about understanding the playing field, seeing opportunities they miss, and building strategies that give you a sharper edge.

Think of it like upgrading from driving through fog to navigating with a GPS. You're still steering your own ship but with far fewer wrong turns.

What is the purpose of competitive intelligence research?

Why bother with CI research when you’re already juggling campaign launches, budget pacing, and creative refreshes?

Because competitive intelligence helps you:

- Gain competitive advantage: Spot gaps in competitor strategies that you can exploit before others do.

- Improve campaign decisions: Instead of A/B testing 10 angles blindly, you start with the 2–3 that you know competitors are doubling down on (or ignoring).

- Inform strategic thinking: CI gives you a bigger picture of your market, helping you prioritize not just ads, but positioning, landing page direction, and budget splits.

Difference between tactical and strategic CI

| Type | Description | Impact for Performance Marketers |

|---|---|---|

| Tactical Competitive Intelligence | Immediate and specific insights, like tracking a new competitor offer on Instagram Stories or spotting a fresh retargeting sequence. | Fuels day-to-day campaign tweaks and optimizations. |

| Strategic Competitive Intelligence | Long-term insights, like identifying repositioning efforts toward new customer segments or shifts from lead gen to product-led growth. | Helps steer quarterly and annual marketing strategies. |

As you can see, both of these matter for performance marketers.

Who uses CI data?

While we’re zeroing in on performance marketing, the insights you gather from CI research don’t live in a silo.

They’re extremely helpful for:

- Marketing teams: Fine-tuning messaging, creative, and campaign targeting

- Product teams: Identifying features or offers competitors are emphasizing

- Sales teams: Building better objection-handling scripts and battlecards

- Founders and leadership: Making better GTM (Go-to-market), pricing, and expansion decisions

In a startup, you might be all those teams rolled into one. And that's exactly why investing in competitive intelligence is one of the highest-leverage activities you can prioritize.

Types of competitive research

When it comes to competitive intelligence research, understanding the types of research you can use is key. Not all information is gathered the same way and not all insights carry the same weight.

At a high level, there are two types you should know:

1. Primary research

Primary research involves collecting information directly from the source. It’s firsthand, raw, and often highly specific to your needs.

In the context of performance marketing, primary research could look like:

- Signing up for a competitor’s email list to track their nurture sequences

- Clicking through ads to experience their full funnel journey

- Interviewing customers who switched from a competitor’s product

- Secret shopping competitor offers to understand their pricing and upsell tactics

Primary research is powerful because it gives you real-world, real-time insights. It might be a bit messy, yes. But it often surfaces competitive advantages you’d never find in public reports.

2. Secondary research

Secondary research is when you analyze information that already exists. You’re tapping into data and insights that someone else has compiled, whether it’s public-facing or available through a tool.

For performance marketers, this usually includes:

- Browsing the Meta Ad Library to study competitor ad creatives

- Using tools like SpyFu to see which keywords competitors are bidding on

- Reading customer reviews on G2 or Capterra to spot messaging gaps

- Monitoring Reddit or niche forums for unfiltered customer feedback

Secondary research is faster and easier to scale. But it sometimes lacks the deep context you can only get through firsthand observation.

Which one to use?

The startups that crush it with competitive intelligence don’t just rely on one type.

They blend primary and secondary research to build a 360° view. Primary research gives you sharp, qualitative insights — the why behind what competitors are doing. On the other hand, secondary research gives you quantitative trends — the what and how much.

So, when you combine both, you understand your competitors more than ever. And that’s where real strategic advantages are born.

Step-by-step competitive intelligence research process for performance marketing

If you want competitive intelligence to be more than just screenshots and spreadsheets, you need a process that's purpose-built for paid media. Competitive intelligence is most useful when it directly fuels better targeting, smarter creative decisions, and more efficient budget allocation. Here's exactly how to do it, step-by-step.

Step 1: Set campaign-specific CI objectives and define direct/ad-level competitors

Every strong CI research process starts with a sharp objective. Always remember that you’re gathering competitor data to solve a specific marketing problem.

Before you even think about tools or data collection, ask yourself:

- What am I trying to improve right now? Is it CTR (Click-through Rate), CPA (Cost per Acquisition), lead quality, or conversion rates?

- What part of my funnel or campaign needs better input?

- Which competitors are most relevant to my current goals?

You don't need to monitor the biggest brands in your industry. Focus on your real competitors — the ones bidding against you, targeting your ICP (Ideal Customer Profile), or appearing in your customers' feeds.

The best way to stay focused is to build a simple list:

- Primary competitors: Brands offering similar products to the same audiences

- Indirect competitors: Companies running ads in your keywords or verticals but solving slightly different problems

- Aspirational competitors: Larger brands whose creative strategies or funnels you can learn from even if they aren't direct threats yet

Being specific about your objective and competitor set saves you from collecting tons of irrelevant information that you’ll never use.

Step 2: Choose research tools

Once you know what you're trying to accomplish, it’s time to choose your research stack. The goal here isn't to use every tool under the sun; it’s to pick a few that get you the right insights with the least overhead.

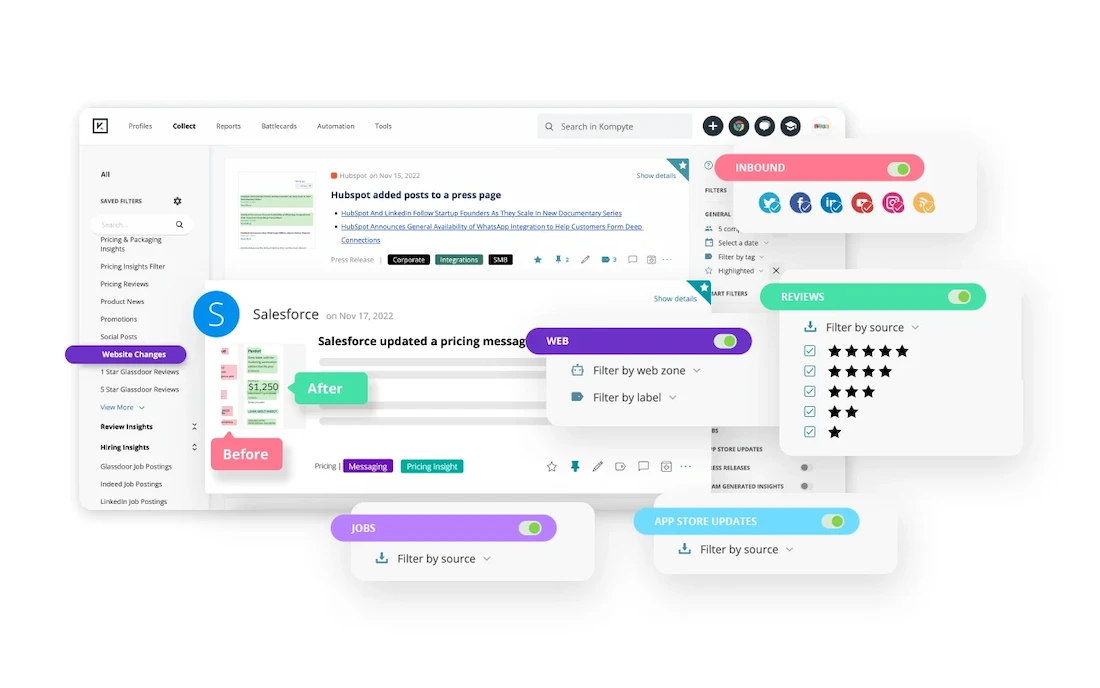

If you're focused on creative and messaging trends, you might rely heavily on free resources like the Meta Ad Library or LinkedIn Ads Library. If you need keyword overlaps and spend patterns, tools like SpyFu or Semrush will be invaluable. For a full competitive monitoring system, especially if you're scaling, platforms like Kaya, Klue, or Kompyte can automate alerts, ad tracking, and battle card creation.

Whatever stack you pick, make sure it answers these questions:

- Can I easily track new ads and landing pages?

- Can I see which competitors are scaling spend up or down?

- Can I gather funnel insights, not just surface-level creative?

Choose smartly. A small set of highly targeted tools beats a bloated toolkit you don't have time to use.

Step 3: Collect ad creatives, targeting cues, and funnel assets

This is where CI research gets tactical and where a lot of marketers either get sloppy or overwhelmed. Don’t just grab random screenshots of ads. Instead, collect data with context and structure.

The goal is to build a complete picture of each competitor’s paid media funnel, not just isolated parts.

Here’s what you should systematically gather:

- Ad creatives: Save examples of headlines, body copy, visuals, CTAs, and format types (static, carousel, video, story ad).

- Targeting cues: Look for clues in the messaging about who they’re targeting — demographics, industries, life events, interests.

- Offers and incentives: Note any discounts, trials, bonuses, or guarantees prominently featured.

- Landing pages: Track the LP (Landing page) experience after ad click — messaging, design, form length, trust elements, urgency drivers.

- Funnel mechanics: Identify whether they use quizzes, lead magnets, webinars, demos, or direct purchases.

But don’t just save files. Label everything clearly: platform, date, offer type, funnel stage. Over time, this will allow you to detect real patterns, not just react to isolated creatives.

The more disciplined you are in the collection, the faster you can turn raw data into winning insights.

Step 4: Analyze spend patterns, messaging trends, and placement strategies

After you've collected enough data, your real job begins: turning it into something actionable.

Start by zooming out:

| Focus Area | What to Look For | Why It Matters |

|---|---|---|

| Spend Patterns | Are competitors ramping up Meta Story ads, cooling Feed placements, or launching new Google Display pushes? | Reveals where they’re seeing the best CPAs and ROI. |

| Messaging Trends | Are emotional triggers like “save time” or “reduce overwhelm” dominating? Are they shifting to exclusivity angles? | Helps you craft fresher, more resonant ad messaging. |

| Placement Strategies | Are they leaning into TikTok UGC (User Generated Content), Meta Reels, or LinkedIn thought leadership? Which formats are they scaling? | Shows what formats or channels are delivering results for them. |

You should be looking for answers to three crucial questions during analysis:

- What’s consistent across multiple competitors? This often signals industry trends or customer expectations you must meet.

- What’s missing that none of them are addressing? This is your creative wedge — the white space where you can stand out.

- What signals emerging opportunities? Early shifts (like more quiz funnels or new ad angles) are goldmines when spotted early.

At this stage, you’re no longer just tracking what competitors are doing. Rather, you’re understanding why they’re doing it and spotting your strategic move.

Step 5: Build and present actionable CI reports for paid media optimization

Finally, it’s time to bring everything together into something your team (or you, if you're solo) can actually use.

A strong CI report doesn’t just dump screenshots and notes. It organizes findings into clear, actionable insights that connect directly to paid campaign tactics.

Structure your report like this:

| Report Section | What It Includes |

|---|---|

| Executive Summary | A 1-page overview highlighting 3–5 critical insights that matter most to decision-makers. |

| Competitive Landscape | Visual mapping of key competitors, their activity levels, and focus areas across channels or campaigns. |

| Findings | Detailed observations with examples, such as “Competitor X is running 70% video ads targeting mid-funnel Instagram users.” |

| Strategic Recommendations | Actionable next steps based on the findings, like “Test urgency-based CTAs in TikTok lead ads.” |

| Evidence Appendix | Supporting materials including screenshots, landing pages, ad links, and creative examples used to back up the analysis. |

Make your report visual and bite-sized. Focus on quick takeaways, not long dissertations. Your ultimate goal is simple: Insights should lead to immediate action in your paid campaigns.

For extra punch, end your report with a "Next 30 Days Action Plan" based on your findings. That way, CI becomes a growth driver baked into your performance marketing roadmap.

Tools and data sources for performance marketers

You can’t do great competitive intelligence research without the right tools. But you also can’t afford to drown in dashboards you’ll never actually use.

The key is to build a lean, powerful toolkit that helps you gather insights efficiently without overwhelming your workflow.

Let’s break it down:

Paid tools

If you’re serious about running competitive intelligence as a core part of your paid media strategy, a few well-chosen paid tools can save you dozens of hours and surface insights you’d never find manually.

Some of the most performance-marketing-friendly platforms include:

Competitor Ad Intelligence tool by Kaya:

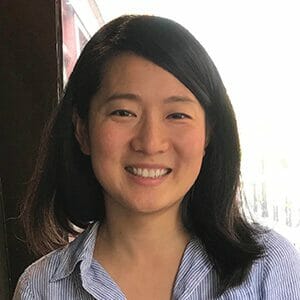

Designed specifically for paid media teams, Kaya’s Competitor Intelligence platform takes the guesswork out of competitive research. Instead of manually scrolling through ad libraries or trying to reverse-engineer funnels, Kaya gives you real-time visibility into how competitors are advertising, positioning offers, and moving budgets across channels like Google, Meta, LinkedIn, TikTok, and Bing.

Built with performance marketers and startup teams in mind, Kaya focuses on what actually matters: actionable, channel-specific insights that can help you optimize faster than your competitors. You can easily track new ad creatives, landing page experiments, and messaging pivots, and even monitor spend trends — all without the bloated complexity of traditional enterprise tools.

If you're a founder, growth marketer, or solo media buyer, Kaya helps you see:

- Where your competitors are investing their ad dollars

- What creative styles and offers they’re betting on

- Which funnels and messaging angles are driving visible traction

In a landscape where budgets need to be deployed smartly, Kaya gives you a clear roadmap to outmaneuver competitors with minimal manual effort.

It’s budget-friendly (comes at $100), lightweight, intuitive, and designed so even non-technical teams can generate powerful, customized reports without extra setup or guesswork.

Competitor Ad Intelligence Tool (COIN) by Kaya

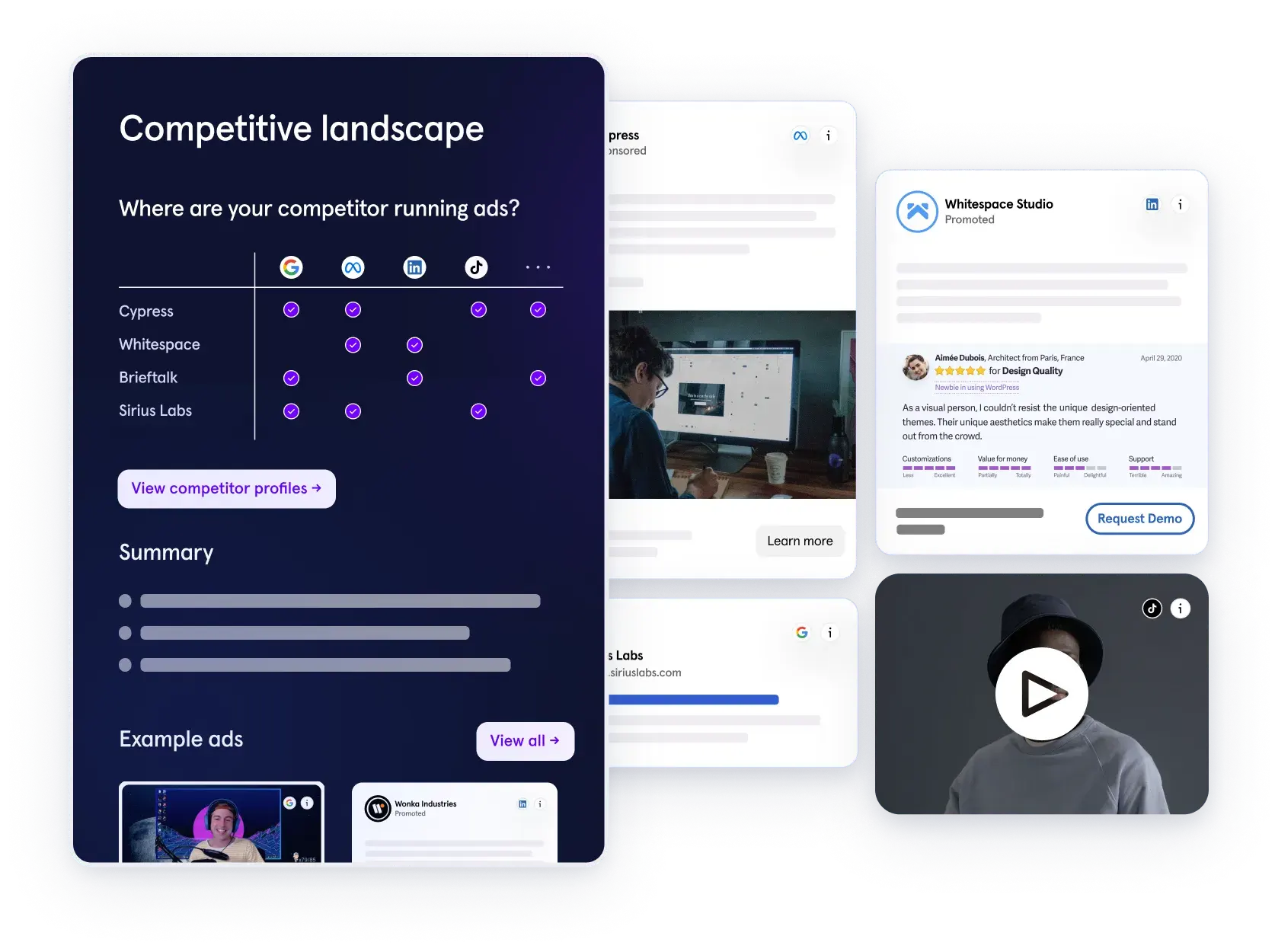

Klue:

Klue shines when you want structured competitor battle cards. This is great for aligning marketing, sales, and leadership around competitive positioning. While it’s heavier on sales enablement, performance marketers can use it to benchmark offers, guarantees, or campaign messaging.

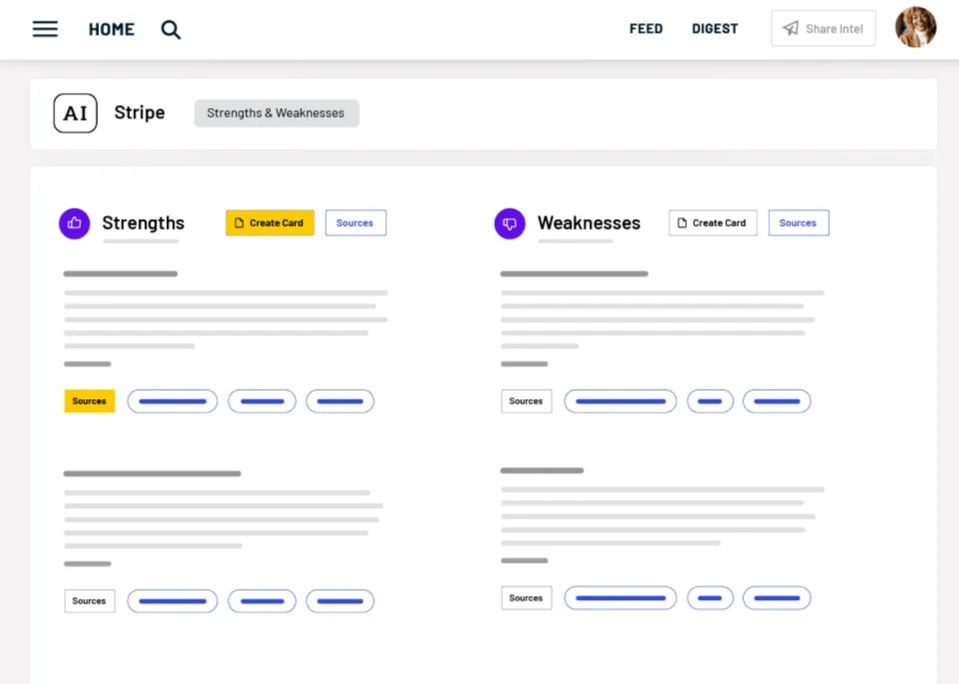

Kompyte:

Kompyte automates the tracking of competitor marketing activities across ads, websites, blog posts, and social media. It's useful if you want to catch not just creative changes but messaging shifts and funnel pivots.

Semrush:

Primarily known for SEO, but its Advertising Research module is gold for performance marketers. You can uncover competitors’ paid keywords, ad copy examples, spend estimates, and historical campaign data.

SpyFu:

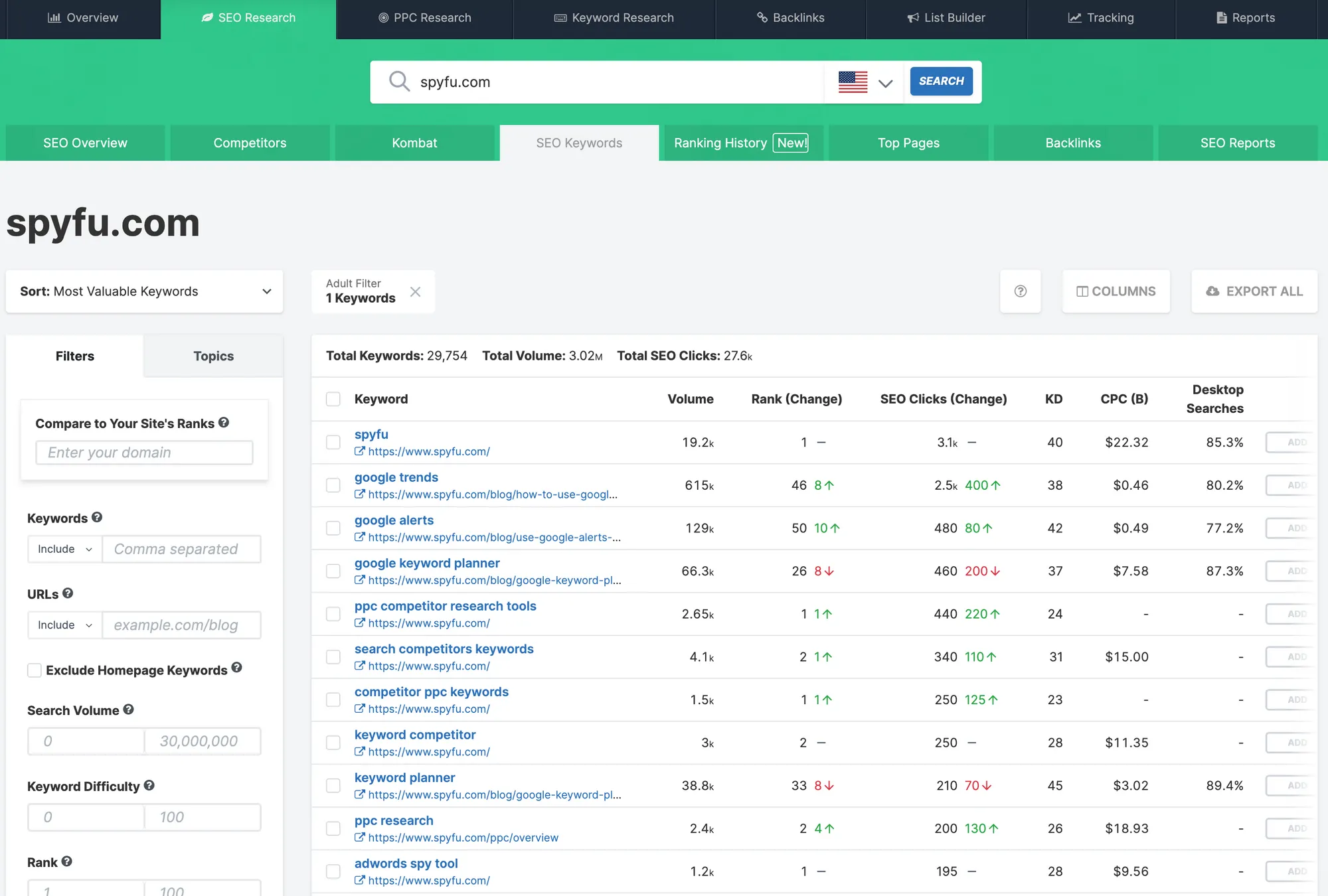

SpyFu offers a sharper, more affordable lens into competitor paid search activity. It's especially handy if you're scaling Google Search campaigns and want to reverse-engineer what your competitors are bidding on.

Similarweb:

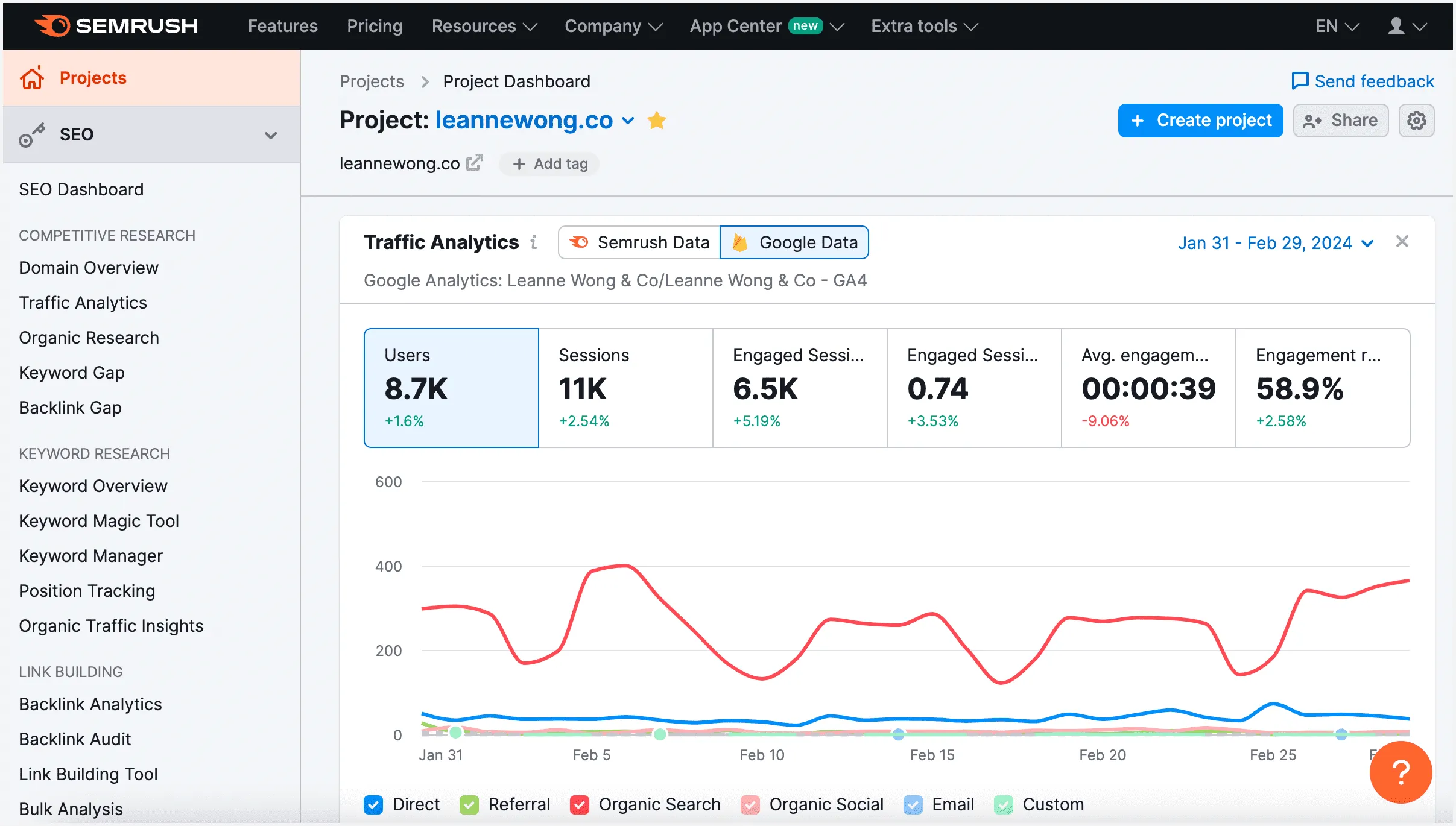

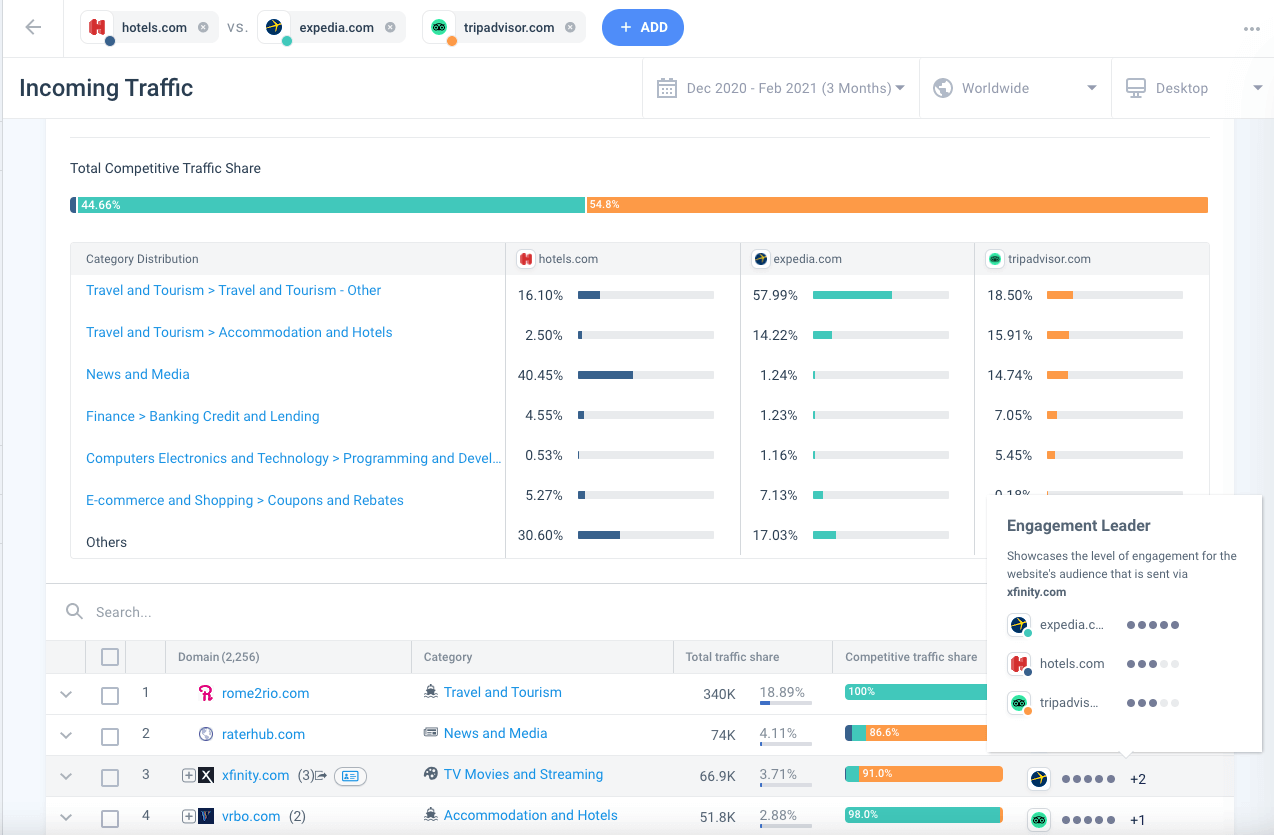

Similarweb gives you traffic intelligence: where your competitors are getting their visitors from, which channels they’re scaling, and how their site behavior looks post-click. This tool is also great for planning landing page optimizations or identifying untapped acquisition channels.

Free sources

When budgets are tight (and even when they’re not), free sources should still be a regular part of your CI stack.

Some of the best free goldmines:

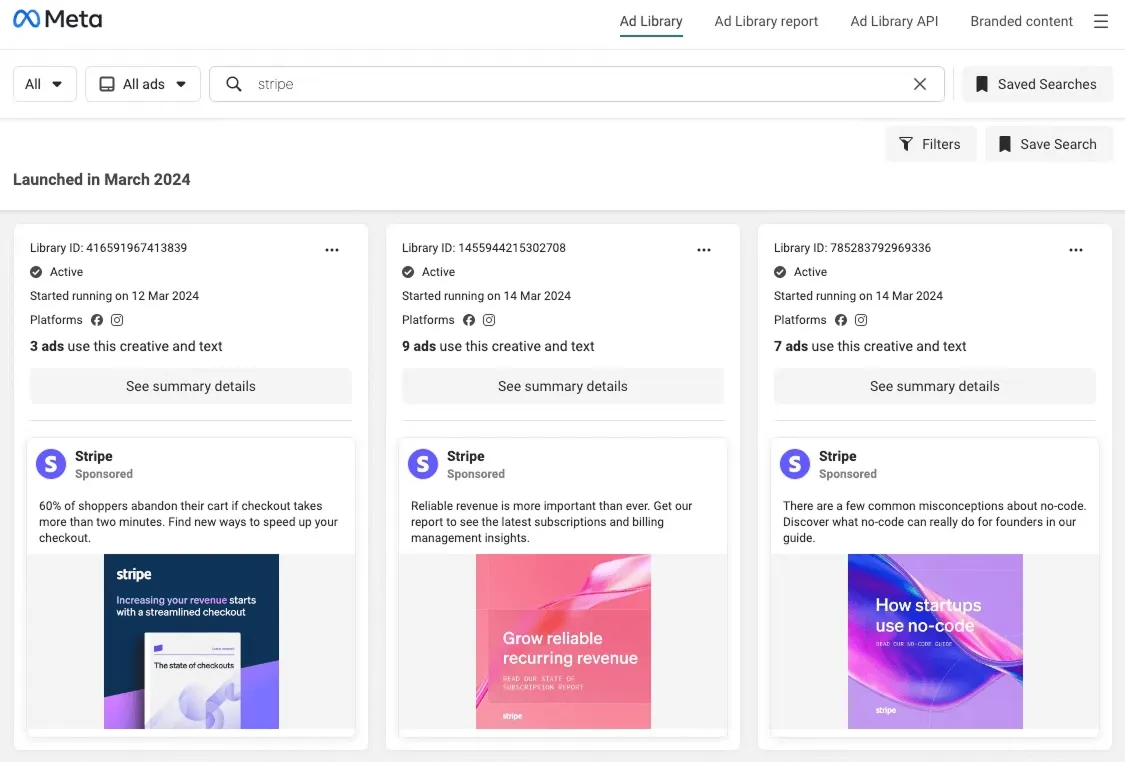

Meta Ad Library:

An absolute must for any performance marketer. You can see every ad currently running from any brand on Meta platforms, giving you direct insights into creative styles, formats, CTA variations, and offer strategies.

Reddit threads:

Customers complain, rave, and ask brutally honest questions on Reddit, especially about B2B SaaS, DTC brands, and newer startups. Searching competitor brand names or product categories can uncover messaging angles no ad would ever reveal.

Google Transparency Center:

Similar to Meta Ad Library, Google allows you to see what ads other competitors are running. You can narrow down your results using extensive filters like platform, time, and location. This is a great and budget-friendly way to do competitor research for bootstrapped companies and brands.

Feedly:

Feedly aggregates news, blogs, and updates across industries. Following competitor blogs, funding news, or niche market publications through Feedly keeps you ahead of positioning changes and market shifts before they hit mainstream paid channels.

Where to find audience targeting and creative messaging

Here’s how to dig deeper:

-

Audience targeting clues: Look for how competitors frame their copy. Are they mentioning job titles (e.g., "For busy founders"), industries ("Marketing agencies love us"), or demographic signals ("Built for Gen Z freelancers")?

-

Creative messaging: Track patterns in emotional triggers. Are they focusing on saving money, winning status, reducing frustration, or unlocking freedom?

Identify which emotional levers they consistently pull — and which ones they might be ignoring.

Here’s a pro tip: Always approach your CI like a detective, not just a browser. Every ad, every landing page, every message gives off subtle signals — if you know where to look.

How to turn competitive intelligence into paid media strategy

Collecting competitive intelligence is valuable. But what separates great performance marketers from good ones is how they apply it. Because at the end of the day, raw data doesn’t drive ROAS (Return on Ad Spend). But strategic action does.

Here’s how to turn your competitor research into real paid media wins.

Extract insights that fuel campaigns

The first step is moving from passive observation to active hypothesis building. Every competitor ad you study, every funnel you analyze, should spark a thought:

“How can I beat this or use it differently to win my audience?”

Look for patterns in your research and immediately turn them into testable campaign ideas. You’re not trying to imitate what competitors do. Rather, you’re looking for:

- Gaps they aren't addressing

- Angles they underutilize

- Overplayed tactics where fatigue is setting in

The goal is to translate insights into smart, high-probability experiments in your paid strategy.

Turn messaging gaps into ad copy ideas

When analyzing competitor messaging, focus heavily on what’s missing. For example:

- Are all competitors promising "save time" but none are emphasizing "peace of mind" or "lower stress"?

- Are they all pushing discounts but no one is highlighting "quality" or "guarantee" benefits?

Once you’ve found answers to these questions, test ad copy that plugs those gaps. Introduce emotional triggers, unique value props, or credibility signals that your competitors overlook.

By attacking whitespace instead of mimicking what's already working for them, you differentiate faster and more effectively in crowded feeds.

Improve landing pages based on funnel intel

Competitor landing pages tell you exactly where the market expectations are and where customers might be getting frustrated.

For instance:

- If you notice competitors using long, heavy landing pages full of buzzwords, you might test shorter, punchier, single-scroll pages.

- If their forms are multi-step and friction-heavy, you might try a 1-click signup flow to lower drop-offs.

Make pacing and budget shift decisions based on Auction Insights

Competitive intelligence doesn’t stop at creatives. It also gives you clues about media buying behavior.

If you see that competitors are heavily investing in:

- TikTok top-of-funnel awareness campaigns

- Meta story placements for retargeting

- Google search retargeting over display retargeting

It often signals shifts in auction dynamics. Costs might be rising fast in one channel while remaining stable in another. Read this blog to learn how to use Auction Insights in detail.

Use CI for better targeting, bidding, placements

Lastly, one of the most overlooked powers of CI is refining who you target and how you bid. By studying competitor targeting clues such as job titles, pain points, and demographics, you can sharpen your audience segments.

For example:

- If competitors are all targeting "CMOs," maybe there’s a ripe segment among "Growth Marketing Managers" who feel overlooked.

- If competitors are bidding heavily on generic terms, you might focus on long-tail, intent-driven search terms that yield better ROI.

To go the extra length, here’s something extra you can do. After every CI review cycle, ask yourself:

- Which new audiences should I test based on emerging messaging patterns?

- Which placements are underutilized but show strong creative adaptation opportunities?

- How can I bid smarter where competitors are overbidding emotionally, not rationally?

When you consistently bake these intelligence-driven moves into your campaigns, you're running strategic offensives.

How to write a competitive intelligence report

Gathering competitive intelligence is only half the job.

If you can’t package it clearly and persuasively, it won’t drive any real action and the opportunity will be lost.

Here’s the best practice checklist to build a CI report that actually influences campaigns and moves strategy forward.

1. Start with an executive summary

Your first page should immediately tell a busy founder, marketing lead, or growth manager exactly what matters — ideally in under 60 seconds. Focus on highlighting three to five critical insights you uncovered and connect each one directly to specific campaign opportunities or risks. Keep the summary tight, impact-driven, and formatted in a way that's easy to skim at a glance. Think of it as answering the question, “What are the biggest things we should act on today?” without any fluff or deep reading required.

2. Map the competitive landscape visually

Don't just list competitors; show the full ecosystem instead. Create a simple visual, such as a grid, quadrant, or timeline, that highlights which brands are active across different channels. Make sure to point out important shifts, like new entrants gaining traction, competitors ramping up ad spend, or brands that seem to be pulling back. A clear visual helps stakeholders spot patterns at a glance, making it far more effective than dense, text-heavy competitor profiles.

3. Break down findings into specific themes

Organize your findings into logical, strategic categories rather than presenting a random collection of observations. Structuring your competitive intelligence around key areas like ad creative trends, offer and incentive strategies, landing page and funnel tactics, audience targeting approaches and channel prioritization makes the insights far more actionable. This approach helps paid media teams quickly zero in on the areas that directly impact their campaigns, instead of sifting through scattered information.

4. Always tie insights to recommendations

Competitive intelligence is useless without clear action steps. For every major insight you present, you should always pair it with a specific recommended action. For example, if you observe that a competitor shifted 80% of their budget toward TikTok short videos, the immediate recommendation could be to test TikTok awareness campaigns using UGC (User generated content)-style short video ads in the next quarter. Creating a tight connection between observation and action ensures that your research directly fuels smarter campaign moves.

5. Include evidence, but keep it curated

Screenshots, landing page links, and ad examples are important because they build credibility and back up your insights with real evidence. However, overwhelming your audience with 50 slides of screenshots will only dilute your core message. The best practice is to curate only the most relevant, pattern-confirming examples and annotate each image to explain why it matters. For instance, point out where a competitor emphasizes ROI over features. Save the bulk of your screenshots in an appendix or an "evidence library" section, so they’re available for deeper dives without cluttering the main narrative. Think of supporting visuals like footnotes: accessible when needed, but never distracting from the primary storyline.

6. Format it for skimming and fast decision-making

Your competitive intelligence report should feel more like a growth playbook than a traditional consulting deliverable. Focus on using short, punchy paragraphs, bolding key actions, and leaving plenty of white space to make it easy to skim. Insert visual dividers between sections to break up the flow, and summarize key takeaways at the start of every major section so readers immediately grasp the main points. Ideally, you should be able to fit the core story into 10–15 slides or about 4–6 pages. Busy teams don’t want to wade through dense research — they want clear, actionable moves they can act on today.

7. Close with a "Next Actions" checklist

Every strong CI report ends with a Next 30 Days Action Plan. Spell out the next steps simply and clearly so that your team knows exactly how to move from research to action. For example, you might recommend launching two new ad variations based on uncovered emotional triggers, testing alternative landing page structures inspired by competitor funnels, reallocating a percentage of your prospecting budget toward emerging low-competition channels, and actively monitoring two new competitors who are rapidly scaling their ad spend. Turning your findings into a straightforward execution plan is what makes competitive intelligence truly valuable: it bridges the gap between insights and measurable marketing impact.

The 7 Ps of competitive intelligence (and how they apply to performance marketers)

When you're building a strong competitive intelligence process, having a clear framework keeps you focused.

One of the best models to guide your thinking, especially in the fast-moving world of paid media, is the 7 Ps of competitive intelligence.

Let’s walk through each P and see exactly how it applies to your work as a performance marketer.

Planning

Without a clear plan, competitive intelligence turns into random browsing with no real payoff. Planning defines exactly what you’ll monitor — whether it’s competitor ad creatives, retargeting funnels, or new offers in a market. A tight plan keeps your research aligned with real campaign needs, not just curiosity.

Purpose

Even great research is useless if it doesn’t have a purpose. Every CI effort should be tied to a specific marketing goal: boosting CTR, improving funnel performance, or uncovering a new positioning angle. A clear purpose helps you separate actionable insights from background noise.

People

Competitive intelligence needs an owner. Whether it's you wearing multiple hats or a small team, someone must be responsible for gathering, analyzing, and applying insights consistently. Treat CI like a campaign asset and build it into your weekly workflow.

Process

A strong process turns competitive intelligence from scattered screenshots into a competitive advantage. Following a simple cycle i.e., identify, collect, synthesize, act, ensures that every insight you gather translates into real performance moves. Without a process, even great data goes to waste.

Priorities

Not every competitor deserves equal attention. Focus your research on brands that bid against you, target your audiences, or show signs of scaling aggressively. Prioritizing the right players keeps your CI lean, focused, and directly tied to protecting and expanding your paid media results.

Productivity

CI is about tracking what matters most. Use tools to automate data collection wherever possible, so you can spend your time spotting trends and building strategies instead of manually gathering screenshots. In competitive markets, speed and focus win.

Performance

At the end of the day, competitive intelligence must drive measurable outcomes. Whether it’s better ROAS, lower CPA, or faster conversions, your research should be judged by its impact on your campaigns. Always tie your CI efforts back to performance to stay focused and continuously improve.

Track these outcomes, even qualitatively, to prove the value of your intelligence work and to refine your process over time.

FAQ

What are different frameworks for competitor analysis research?

What is competitor ad analysis?

How do you find competitor paid ads?

How do you analyze competitor's ads?

How to spy on competitors' ads?

Final thoughts

When you invest time in gathering the right insights, you stop guessing.

You stop blindly copying what’s trending.

You start making smarter, faster decisions that drive better ROI with every campaign you run.

Whether it’s spotting messaging gaps, finding overlooked audiences, or staying one move ahead in ad auctions, CI research turns you from a follower into a strategist.

It’s what allows small, scrappy teams to outperform bigger, better-funded competitors — not by spending more, but by thinking sharper.

But here’s the honest truth: Manually building competitive intelligence reports takes time. A lot of it. Tracking dozens of competitor ads, mapping funnels, analyzing messaging patterns — it’s doable when you have one or two competitors.

But once you’re scaling campaigns across multiple products, markets, or channels, keeping up manually gets overwhelmingly fast. That’s where competitive intelligence tools like Kaya come in.

Having visibility of all data in one place makes it so much easier to understand what's going on. We're now much more confident in our decision making. It’s not a coincidence we're seeing CTR up by 4x and conversion doubling since we started using Kaya.

Platforms built specifically for marketers take the heavy lifting off your plate. They will track which platforms your competitors are prioritizing, which type of ad they are mostly using, and what keywords they are bidding on. As a result, you get real-time insights neatly organized without having to manually screenshot, spreadsheet, and sort every week.

The best part? You don't need to be technical to use them.

Modern CI tools are designed so that any growth marketer, founder, or media buyer can quickly generate actionable, tailored reports without touching a line of code.

If you're serious about using competitive intelligence to drive real paid media results, investing in the right tool isn't just convenient. It's strategic.

Now you know how to run CI research the right way.

Your next step should be to build it into your marketing habit and give yourself the advantage your competitors won't see coming.