Do you know a common trait among the Fortune 500 companies? 90% of them rely on competitor analysis to fine-tune their business strategies.

And when it comes to advertising, we bet the number will just keep on increasing.

In today’s world, paid marketing feels like a high-speed treadmill. Platforms are evolving weekly, ad costs are climbing unpredictably, and what worked three months ago might flop tomorrow. Amid this chaos, it’s tempting to look inward, run isolated tests, and “figure things out” from scratch.

But if your competitors are already spending thousands (or millions) to test ad creatives, offers, and funnels, why not learn from their mistakes and wins before spending your own dollars?

That’s the power of reverse engineering.

Instead of building a paid marketing playbook from scratch, this approach shows you how to deconstruct your competitors’ live campaigns and extract the underlying insights — their messaging, funnel, targeting, creative bets, and optimization cadence.

The best part about reverse engineering your competitor’s marketing playbook is that you don’t need a $10K/month analytics stack or a 4-hour workshop to do this. You just need 30 minutes, a few free tools, and a sharp lens.

In this guide, you’ll learn how to:

- Uncover exactly where your competitors are spending and why

- Spot advertising mistakes they’re making (so you don’t repeat them)

- Decode their funnel stages, creative sequencing, and performance benchmarks

- Turn that teardown into a streamlined, smart paid marketing strategy for your team

Reverse engineering doesn’t mean copying at all. Here, you understand the strategic logic behind their execution. Because when you see the why behind the what, you unlock better decisions, faster tests, and smarter growth.

Ready to get tactical? Let’s start with the foundation.

What is a performance marketing playbook?

A performance marketing playbook is a tactical reference guide that outlines how your team consistently acquires customers through paid channels and how those efforts are measured, optimized, and scaled.

Think of it like your go-to-market engine's operating manual for paid advertising. It doesn’t just tell you what channels you use; it explains how you use them, why you make certain creative or targeting decisions, and what success actually looks like at every stage of the funnel.

At a minimum, a strong performance marketing playbook includes:

- Your core channels and campaign types: e.g. Google search vs Meta retargeting vs LinkedIn lead gen

- Target audiences and personas: Segmented by intent, awareness stage, and buying triggers

- Key messaging themes and offers: What you're saying, to whom, and why it converts

- Creative guidelines and ad formats: What works visually and narratively across each platform

- Landing page flows and funnel paths: Including variants by channel, segment, or awareness stage

- Campaign KPIs and benchmarks: ROAS, CAC, CTR, CVR, AOV, and more — based on goal and spend tier

- Budget allocation principles: Including test-to-scale ratios, seasonality, and risk tolerance

- Testing and optimization loops: Clear timelines for when to pause, scale, rotate creatives, or iterate landing pages

- Governance and workflows: Who launches what, how learnings are documented, and how new hires ramp quickly

A performance marketing playbook is mainly formulated to ensure marketing alignment, build efficiency, enable scalability, and maintain brand consistency as your team grows.

Startups often confuse this with a marketing plan. But a plan is time-bound and strategic. A playbook is ongoing and executional. It’s how the work gets done day-to-day in your ad engine.

If you're running paid media without a performance playbook, you're likely making disconnected decisions across channels, relying on guesswork or past wins, losing velocity every time a team member leaves, joins, or switches roles, or simply repeating advertising mistakes because insights aren’t codified.

Whether you're spending $3K/month or $300K/month, a clear, centralized playbook gives your team focus, consistency, and speed. And the fastest way to build one is to start by reverse engineering someone else's.

Understanding the anatomy of a paid marketing playbook

Although we have slightly covered the key elements that a paid marketing playbook should cover, it’s time to get into the details. Before you start reverse engineering your competitors, it is important that you know what you’re looking for.

Let’s break that down.

Core components of a high-performing playbook

- Channel strategy

- Which platforms are prioritized and why?

- What role does each channel play in the funnel — top, mid, or bottom?

- How are budgets split across awareness vs conversion?

- Audience segmentation

- Who are they targeting at each stage of the journey?

- How do they differentiate between cold, warm, and hot audiences?

- Are there specific verticals, job titles, or intents they focus on?

- Messaging hierarchy

- What value propositions are emphasized first?

- How is messaging tailored by segment or funnel stage?

- What emotional or logical levers do they pull?

- Creative framework

- What types of creatives are used on which platforms?

- Are they using UGC, founder-led videos, static graphics, or product demos?

- How do they test and rotate visuals over time?

- Landing page flows

- Do they drive to short-form or long-form pages?

- Is the CTA lead-gen focused or direct response?

- Are there funnel-specific variants?

- Measurement and KPIs

- What metrics are tracked per campaign?

- How are decisions made around pausing, scaling, or iterating?

- Are benchmarks adjusted by audience, platform, or spend?

- Testing cadence

- How often do they test new creatives, copy, or landing pages?

- Are there clear thresholds for success/failure?

- Do they follow a structured test → learn → optimize loop?

- Team workflows and execution rhythm

- Who owns what? How fast do they launch and iterate?

- Are learnings shared internally? Are SOPs followed?

Most brands don’t fail because their product is bad. They fail because their marketing execution is inconsistent.

We have already mentioned the shortcomings that you might face as a brand without a marketing playbook to refer your actions to.

And reverse engineering your competitor’s performance marketing playbook is your cheat code to make yours more fool proof and successful. You don’t just see what your competitors are doing. You understand how they think, why they execute a certain way, and what’s likely driving performance behind the scenes.

And that’s your advantage.

Tools you’ll need to reverse engineer your competitor’s paid marketing strategy

You cannot just go around guessing why your competitor did what. To make this approach successful, you need the right tools to decode what’s publicly visible. You don’t need access to their ad account, you just need to know where to look and what to extract.

Below is a list of tools, both free and paid, that give you visibility into the exact elements of a performance marketing playbook: targeting, creative, funnel, and strategy.

Free tools

-

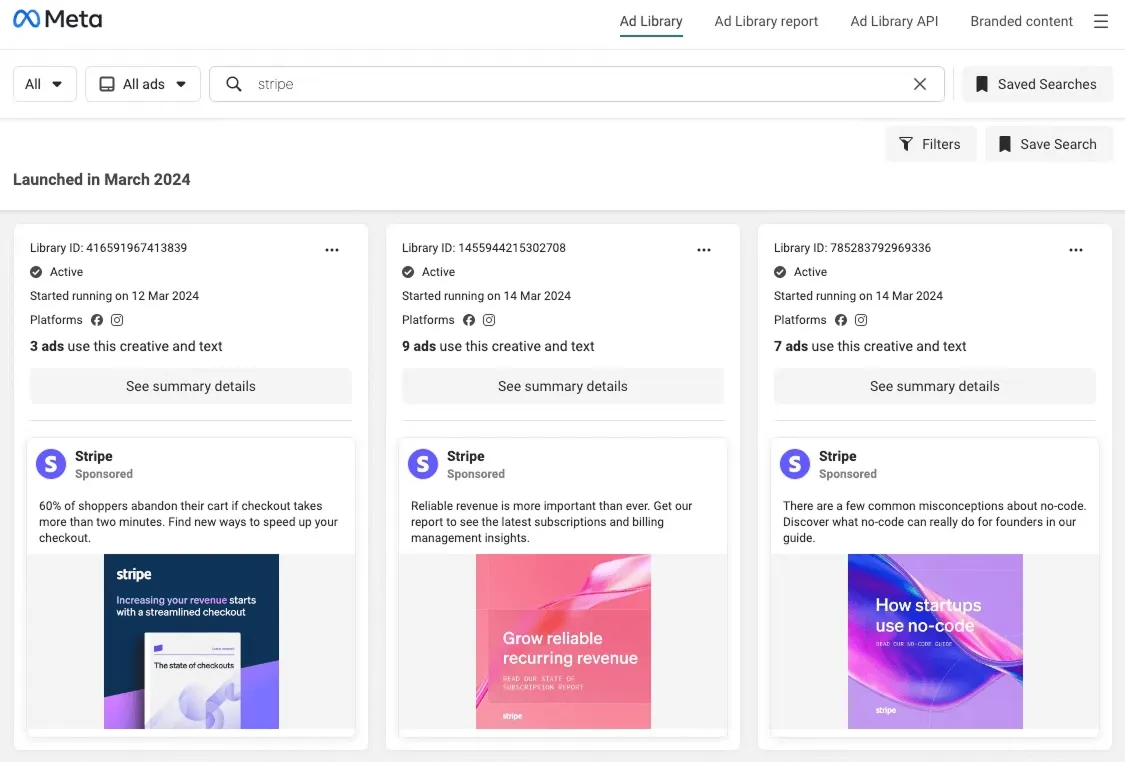

Meta Ads Library

- Lets you see all active ads a brand is running on Facebook and Instagram

- Filter by country, platform, and date launched

- Observe creative variations, copy tone, and offer positioning

What to extract: creative testing approach, messaging hierarchy, call-to-action patterns

Meta Ad Library

-

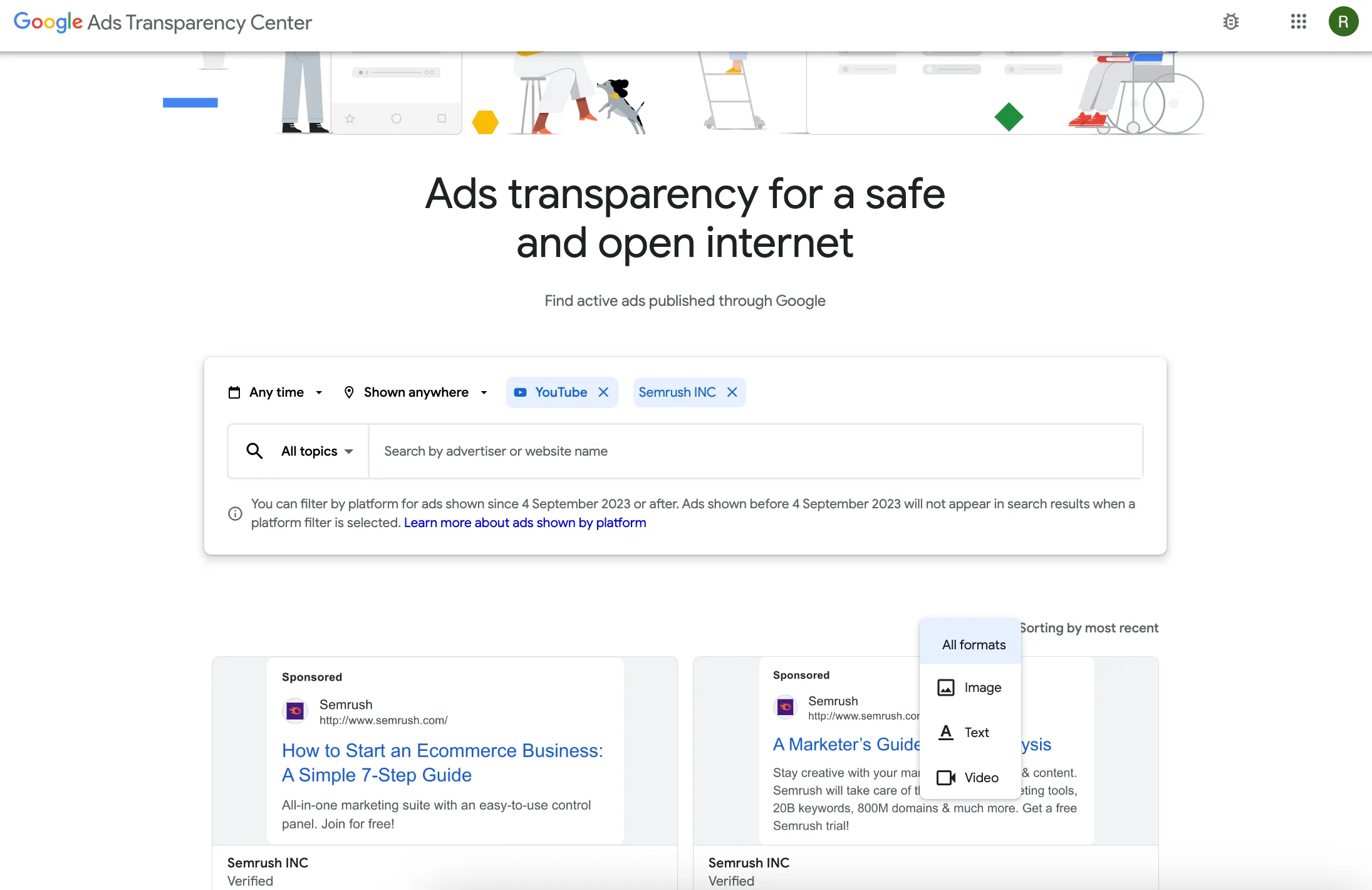

Google Ads Transparency Center

- Shows search and display ads run by a brand, including when and where they appeared

- Useful for brands running demand capture or branded search campaigns

What to extract: headline structure, use of sitelinks, search intent targeting

Google Ads Transparency Center

-

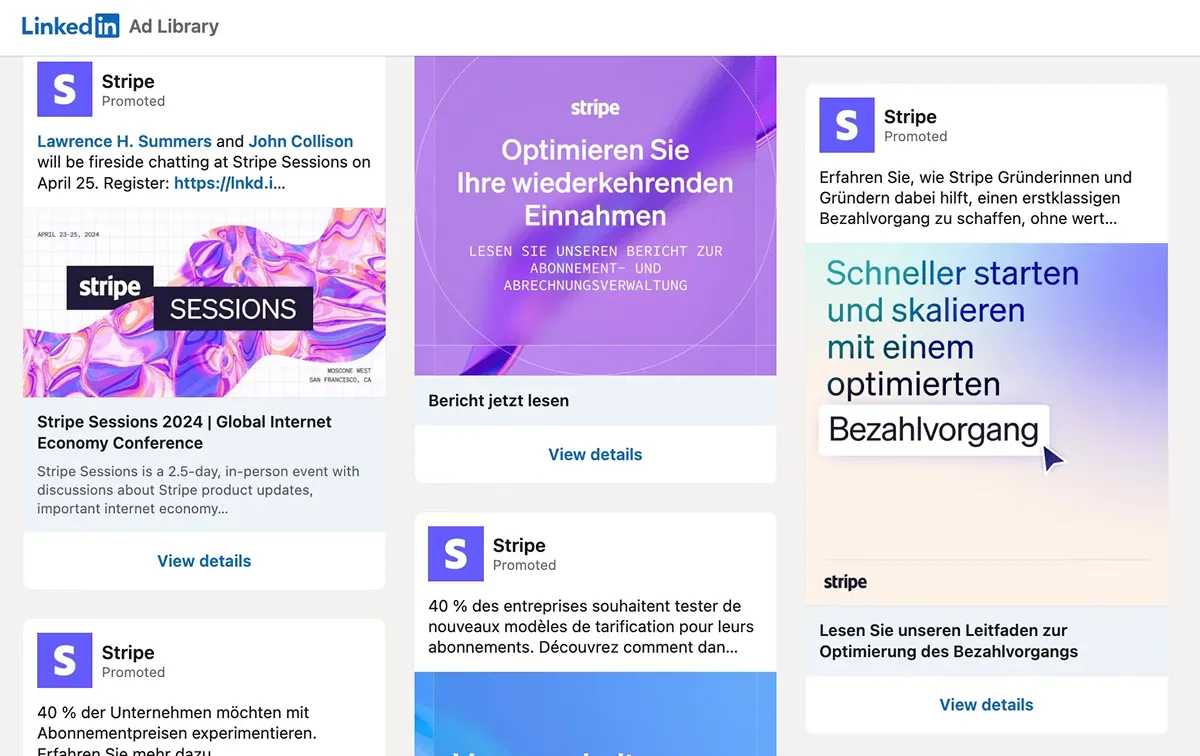

LinkedIn Ads Library

- Not an official ad library, but you can often find sponsored content under a brand’s Activity feed

- Focuses on B2B, thought leadership, and lead gen ads

What to extract: tone of voice, ad format choices, targeting via roles/industries

LinkedIn Ad Library

-

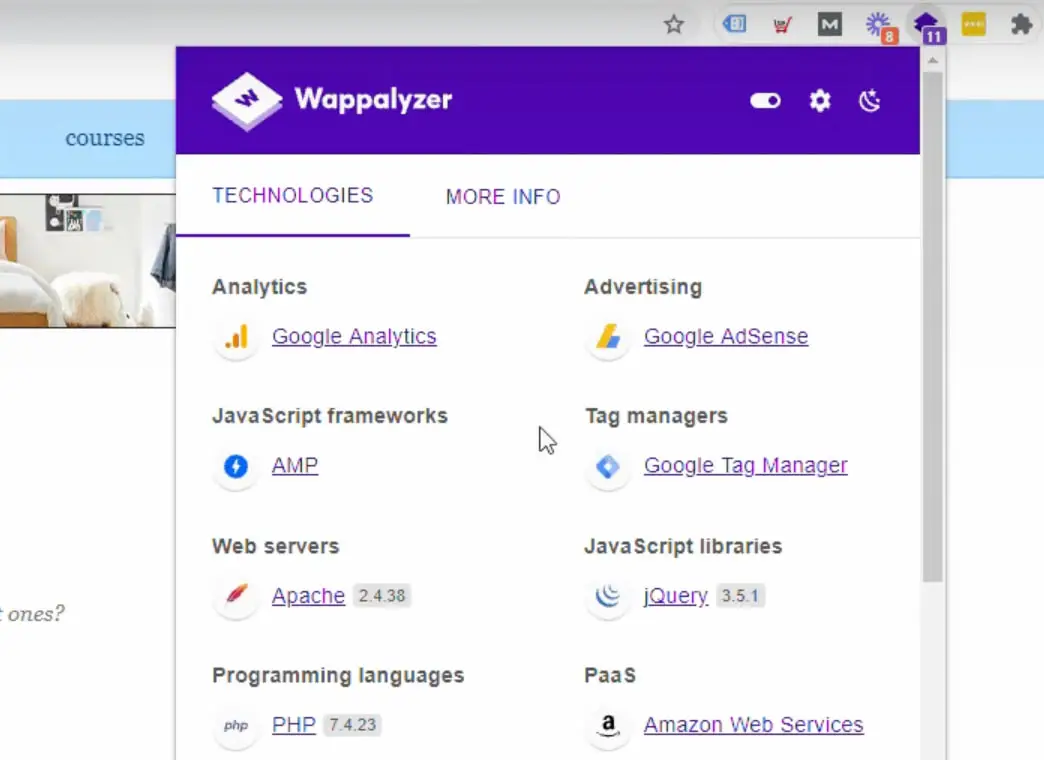

BuiltWith, Wappalyzer

- Use these to see if a competitor is running tracking pixels (Meta Pixel, Google Tag Manager, etc.)

- Helps confirm if they’re actively investing in performance tracking

What to extract: Martech stack, funnel instrumentation, retargeting infrastructure

Besides a dashboard, Wappalyzer also offers a free Chrome extension to track competitors' marketing analytics stack.

Paid tools

-

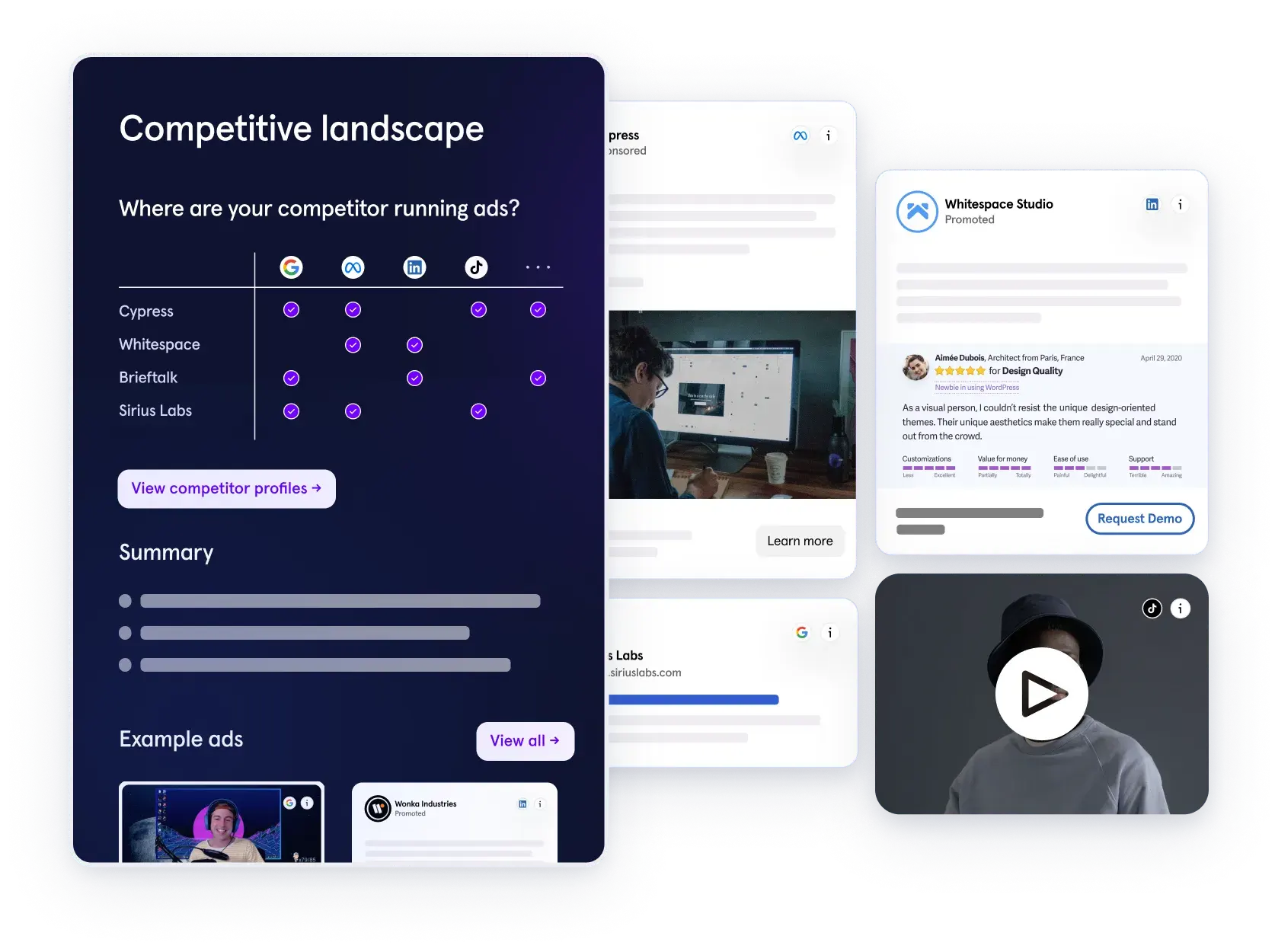

Competitor Ad Intelligence Tool (COIN) by Kaya

If you’re spending hours manually scanning ad libraries, screenshotting funnels, or guessing where competitors are moving budget, you’re wasting time you could be spending scaling.

Kaya’s Competitor Intelligence platform is built specifically for paid media teams and founders who want a faster, clearer way to track how competitors are running paid ads across Google, Meta, LinkedIn, TikTok, and Bing.

It cuts through the noise and gives you exactly what matters:

- Where your competitors are investing their ad dollars

- What creative formats, messaging angles, and offers they’re testing

- Which landing page flows and funnel pivots are driving visible traction

- Real-time insights into spend patterns, so you can spot shifts before they impact you

There’s no complex setup, no unnecessary features, and no bloated dashboards to navigate. Kaya is intentionally focused on what matters most: giving you clear, reliable insights to understand and respond to competitor moves faster.

If you’re serious about out-executing (not just out-spending) your competitors, Kaya gives you the visibility edge you’ve been missing.

What to extract: competitor channel mix, creative style patterns, landing page strategies, messaging shifts, spend allocation trends

Competitor Ad Intelligence Tool (COIN) by Kaya

-

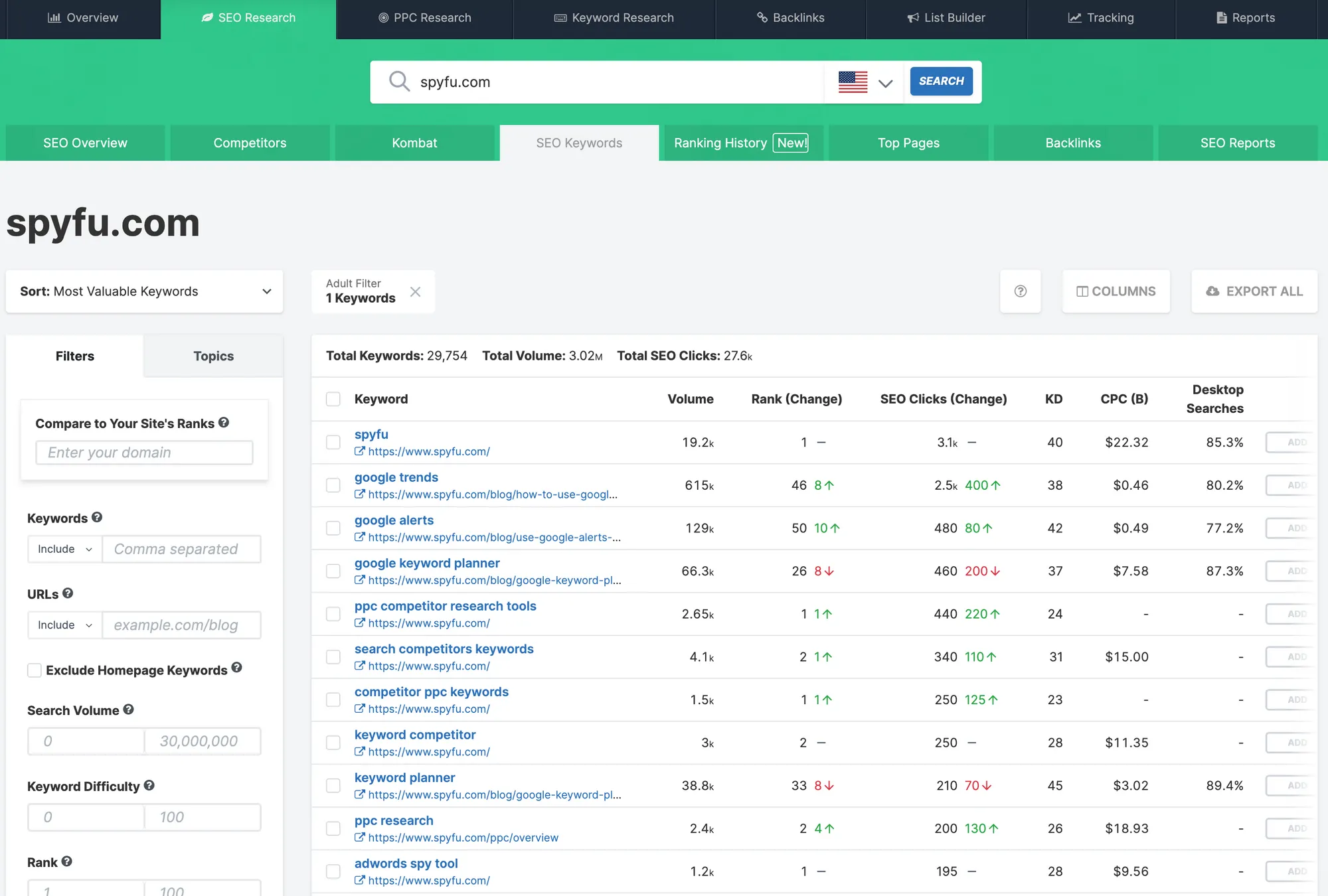

Semrush, SpyFu

- See what keywords competitors rank for and bid on in search ads

- Understand ad copy variations, ad spend estimates, and historical trends

What to extract: keyword themes, competitor spend patterns, search funnel strategy

SpyFu

-

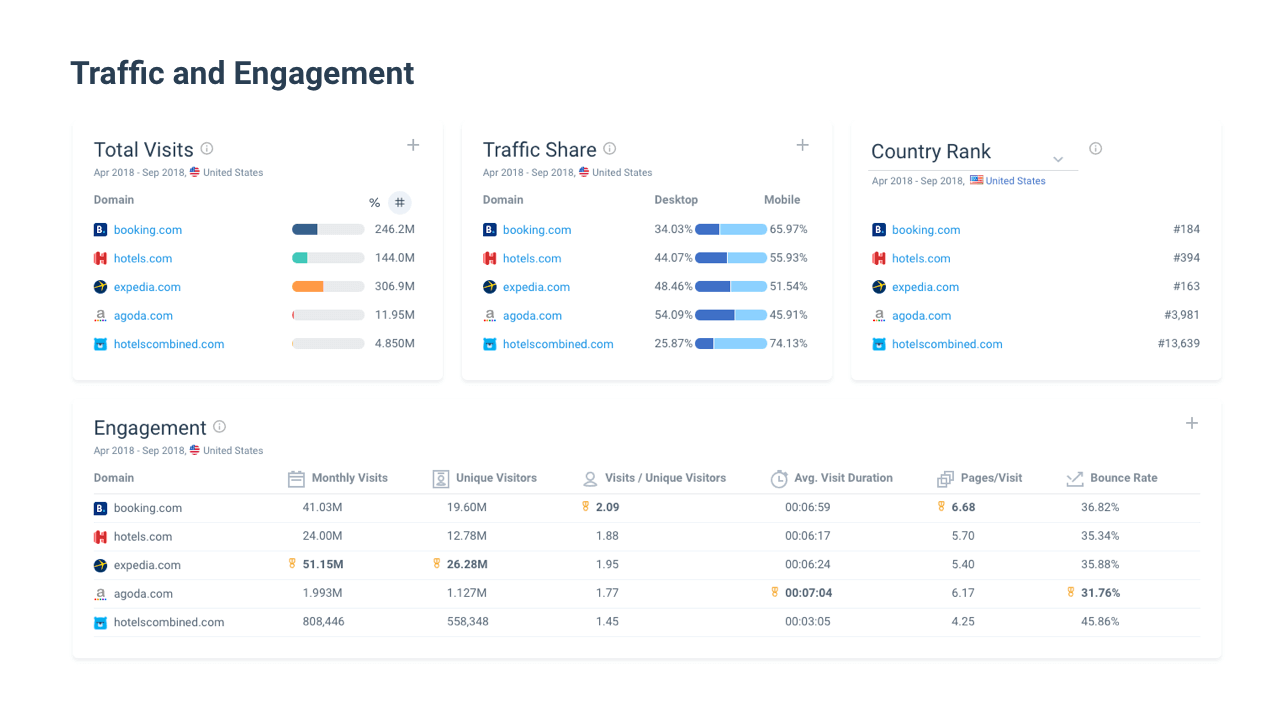

Similarweb

- Offers insights into top traffic sources, referrers, paid vs organic split, and funnel destinations

- Great for spotting where paid traffic is being driven and how much they’re spending

What to extract: paid acquisition channels, landing page behavior, benchmark metrics

Similarweb

-

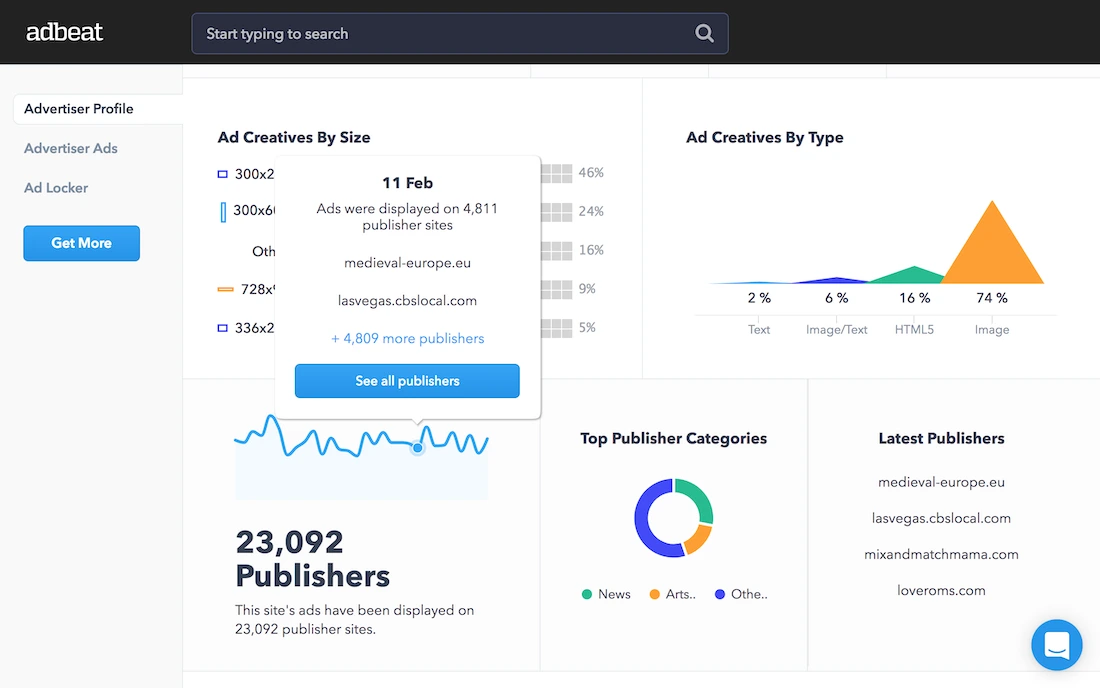

Adbeat, Moat

- Shows display and video ad creatives across multiple platforms

- Especially useful for ecommerce or B2C brands using native and programmatic

What to extract: display ad formats, creative types, media buying trends

Adbeat

-

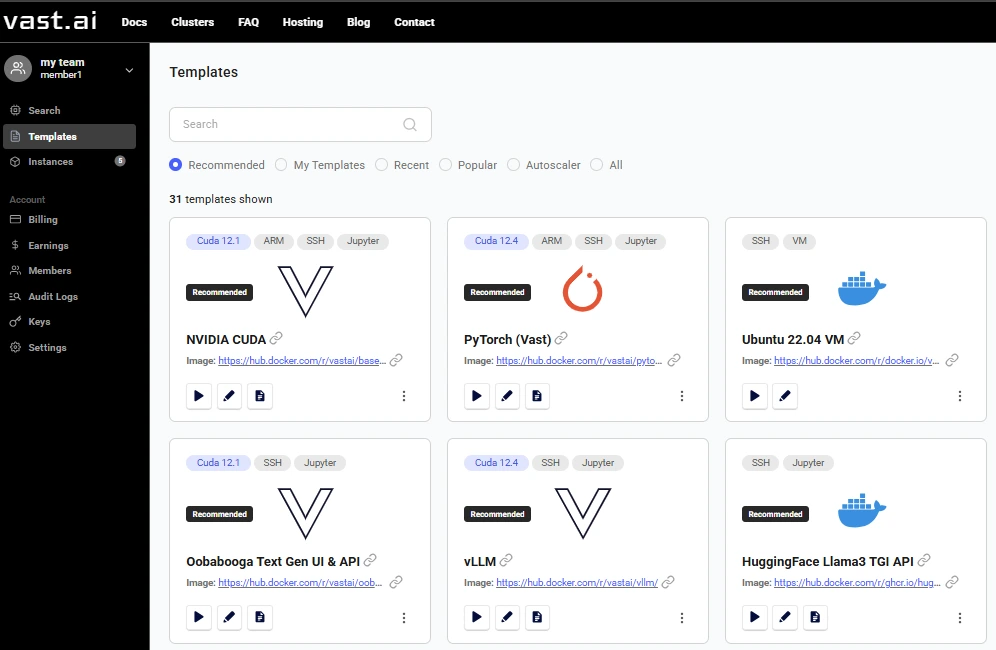

Vast.ai, Peeking AI, or other creative scrapers

- Use these for scraping ad creative archives and sequencing (e.g. seeing how creatives evolve over time)

- Ideal if you're doing deeper teardown across funnels

What to extract: creative evolution, A/B testing history, message consistency

Vast.ai

Check out this listicle for more suggestions on competitor ad intelligence tools.

How to choose the right competitor ad intelligence tool(s)

You don’t need to use all of these. Pick tools based on:

- Where your competitors are spending (e.g. Meta vs Google vs LinkedIn)

- What kind of insights you want (creative vs funnel vs keywords)

- How deep you want to go (free snapshot or ongoing monitoring)

The goal isn’t to stalk your competitors, it’s to understand what they’ve already validated so you can avoid unnecessary spend, move faster, and build a smarter playbook.

Step-by-step teardown: Reverse engineering competitor playbook in 30 minutes

Step 0 of reverse engineering your competitor’s performance marketing playbook is to identify the WHY. Why do you want to do it in the first place? As soon as your can identify that WHY, everything will fall into place accordingly.

Even so, these five steps are non-negotiable if you’re in a time crunch, or say you have only 30 minutes!

Step 1: Identify your top 2–3 closest competitors

(Time: 5 minutes)

You want to reverse engineer companies that your potential customers might realistically choose over you. Avoid aspirational benchmarks if they operate at a totally different budget, funnel, or audience level.

How to do it:

- Search your main product or category keyword on Google. Check who’s running search ads.

- Ask your sales team or customer success team: Who do prospects mention most often?

- Use tools like G2, Capterra, or Clutch to identify similar players based on shared categories or verticals.

- For early-stage startups, look for brands targeting the same buyer persona or pain point, even if their product differs slightly.

Example:

If you're a B2B fintech automating invoice reconciliation, your direct competitor might be Ramp or Fazeshift, while indirect ones could be Bill.com or Airbase — anyone solving parts of the same pain with similar messaging.

What to extract:

- Their domain name, social handles, and brand names

- Category positioning (e.g. “modern payroll for startups” vs “automated payroll for enterprise”)

- Clues about who they’re for (SMBs vs mid-market vs enterprise)

Step 2: Find their active ads and create a snapshot

(Time: 8 minutes)

Now that you know who to analyze, it’s time to pull their live campaigns and map their creative strategy. This way, you’re not just saving ads; you’re observing their creative sequencing, positioning hierarchy, and testing maturity. You’re also seeing what they’re emphasizing right now and where they’re putting their budget weight.

How to do it:

- Go to Meta Ads Library. Search their brand name

- Open the Google Ads Transparency Center. Enter their domain

- For LinkedIn, go to their company page. Scroll through the Activity tab. Look for "Sponsored" content

- Optionally use Semrush/SpyFu to pull search ad examples and keyword bids

What to capture:

Create a spreadsheet or Notion board with:

- Ad headline + copy (record tone, value props, emotional triggers)

- CTA used (e.g. “Book a demo,” “Try free,” “Download now”)

- Visual format (video, carousel, static, UGC, motion graphics)

- Platform (Facebook, IG, LinkedIn, Google Search/Display)

Red flags to look for:

- Are they testing 10+ creatives but all say the same thing? (Signal: shallow testing)

- Are they using generic CTAs like “Learn more” for bottom-funnel offers? (Signal: poor funnel alignment)

Step 3: Click through to study landing pages and funnel design

(Time: 7 minutes)

What happens after the click is where you get real funnel intel. This shows how they handle conversion, messaging continuity, and qualification.

Ads don’t exist in isolation. The page experience confirms the intent of the campaign and gives clues about performance logic. High-converting brands often follow a clear funnel arc from ad creative to message match to form the next step.

How to do it:

- Click on 2–3 live ads and open the landing pages in new tabs

- Take screenshots, scroll all the way down, and record:

- Headline and subhead clarity (is it benefit- or feature-led?)

- CTA placement (top of page? mid? repeated?)

- Page structure (hero section → proof → CTA → product details)

- Lead form friction (fields, required info, gated vs ungated)

- Trust elements (logos, testimonials, reviews, compliance)

- Use BuiltWith or Wappalyzer to see if they're running Google Tag Manager, Meta Pixel, Hotjar, etc. This shows if they’re optimizing funnel performance.

Example patterns:

- If you see a simple demo form right after a TOFU ad, they’re likely testing hard conversion for cold traffic — risky but fast.

- If you see an ebook or ROI calculator offer, they’re warming leads before sales contact. Hence, more nurture-oriented.

What to extract:

- Page type (long-form sales page, short demo page, product-led page, etc.)

- Funnel depth (is this TOFU, MOFU, or BOFU?)

- Value exchange (are they trading insights, access, or urgency?)

Step 4: Reverse engineer targeting and audience assumptions

(Time: 5 minutes)

Even though you can’t see their exact targeting settings, you can make informed guesses based on their creative, copy, and platform usage. Most advertising mistakes happen when messaging doesn’t match audience awareness. This way, you’ll start spotting brands who are under-educating cold traffic or over-pitching TOFU prospects.

How to do it:

- Re-read ad copy and note any segmentation clues:

- “Built for founders” vs “Loved by HR teams”

- Mentions of industry verticals or job titles

- Use of emojis, casual tone, or jargon

- Match that against where the ad runs:

- LinkedIn suggests B2B intent

- Meta often indicates broader awareness play

- Google Search points to bottom-funnel, intent-driven traffic

- Check page paths or UTMs if visible (e.g.

/startup-fundingor/solutions/healthcare). These often indicate the specific audience segment, industry vertical, or use case the ad is trying to attract. It’s a quick way to spot which personas or intent buckets the campaign is designed for, even when you can’t see the exact ad account targeting settings.

Examples:

- A fintech ad with “Stop losing revenue on failed payments” + Google Search = Bottom funnel, high-intent targeting.

- A productivity tool using lifestyle UGC on Meta = likely running broad interest-based or lookalike targeting.

What to extract:

- Which audience segments they’re targeting

- How much education their copy assumes (awareness level)

- Whether the ad is designed for cold, warm, or hot traffic

Step 5: Infer their KPIs and optimization logic

(Time: 5 minutes)

Finally, zoom out and study the duration, depth, and cadence of their campaigns. What they keep running tells you what’s working. This gives you a directional read on what’s converting without needing their analytics access. You can triangulate their goals, maturity, and risk appetite by watching what stays live, what scales, and what gets dropped.

How to do it:

- In Meta Ads Library, sort ads by date launched

- Which ads have been running the longest?

- Which creatives have multiple versions?

- Are some messages repeating across platforms?

- In Google Ads Transparency, see if certain campaigns run continuously (e.g. always-on branded search)

- On LinkedIn, check post dates — did they promote the same asset multiple times?

- Use Semrush or SpyFu to analyze:

- Consistently used paid keywords

- Estimated ad spend volatility

- Organic vs paid traffic for their key landing pages

What to extract:

- Priority offers or hooks they’re investing in (e.g. “Free benchmark audit”)

- Creative fatigue patterns (e.g. how often do visuals change?)

- Conversion benchmarks (how aggressively they test CTAs, pages, or hooks)

Common advertising mistakes you’ll spot (and how to avoid them)

As you start tearing down competitor ads, you’ll notice patterns — some worth emulating, others best left behind. These are the 5 most common advertising mistakes you’ll likely see. Spotting them early means you won’t repeat them in your own playbook.

1. Copy without context

Mistake: Brands recycle the same message across every channel and audience.

Why it hurts: Cold audiences need education. Warm leads need urgency. One-size-fits-all copy fails both.

Avoid it: Match message to stage e.g., TOFU = pain, MOFU = promise, BOFU = proof.

2. Misaligned audience targeting

Mistake: Ads clearly built for decision-makers are shown to general roles or broad interest groups.

Why it hurts: Wasted spend and low engagement. Even great ads fall flat when shown to the wrong person.

Avoid it: Look for clues in copy and UTM paths. Refine targeting logic and layer intent signals.

3. Weak CTAs or vague offers

Mistake: CTAs like “Learn more” or “See how it works” without clear value exchange.

Why it hurts: Low click-through rates and poor downstream conversions.

Avoid it: Use CTAs that complete the sentence “I want to…” e.g. “Get free audit,” “See ROI in 2 mins.”

4. Static, untested creatives

Mistake: No variation in visuals or copy across months. Same static graphic, same headline.

Why it hurts: Ad fatigue sets in. CTR drops. Spend gets inefficient.

Avoid it: Refresh creatives every 2–4 weeks. Test different formats: video, UGC, stat cards, testimonials.

5. Ignoring the funnel

Mistake: Driving cold traffic straight to a demo form or pricing page with no education or value upfront.

Why it hurts: High bounce rates, low conversion rates, and frustrated visitors.

Avoid it: Build modular funnel stages — TOFU (guides), MOFU (tools), BOFU (conversion pages).

These are the mistakes that compound quietly. Left unchecked, they bleed budget and erode trust. But when you can spot them in others’ playbooks and design yours to avoid them, you give your brand a sharper edge in every campaign.

What to do with your teardown insights

So you’ve mapped your competitors’ paid media i.e., their creatives, funnels, and mistakes. Now what? The goal isn’t to sit on a Notion doc filled with screenshots but rather turn them into actionable insights, comprised together as a playbook.

Here’s how to turn those insights into execution:

1. Distill what’s working

Look across platforms and campaigns. Are there patterns in:

- Messaging that consistently reappears?

- Creative formats (UGC, carousels, founder videos)?

- Offers or CTAs that dominate?

Highlight repeat winners. If a competitor’s testimonial ad has run for 6 months, it's likely converting. Treat it as a validation point aka not to copy, but to understand why it works.

2. Flag mistakes and missed opportunities

You likely spotted missteps: poor funnels, stale visuals, vague copy. That’s your edge.

Use these to create a “Do Not Repeat” list. Bake it into your internal campaigns. If a competitor skips MOFU entirely, you could win there with a lead magnet or product quiz.

3. Build your own playbook v1

Use the teardown to fill out your playbook framework:

- What audiences will you prioritize?

- Which messages and formats align with your funnel?

- What KPIs will define success at each stage?

You don’t need any big, detailed content. Start small but make sure to document what you'll test at least in the next 30 days — across copy, creative, audience, and landing pages. Keep it tactical, not theoretical.

4. Set up a simple testing cadence

Your competitor analysis is a head start, but your real insights will come from your own data.

Choose 1–2 ideas to test every week. Track CTR, CVR, and ROAS. Rotate quickly. Share wins internally. Update your playbook every month.

The best playbooks aren’t perfect, but they’re active, flexible and adaptable. Your teardown might give you the strategic direction, but is your execution that will give you the ultimate results.

30-minute checklist to reverse engineer competitor's ad playbook

Use this checklist anytime you want to quickly understand how a competitor is acquiring customers through paid ads and how to use those insights to sharpen your own strategy.

Before you start

- Identify 2–3 direct or indirect competitors

- Create a workspace (Google Doc, Notion board, or spreadsheet) to capture findings

- Set a 30-minute timer. Stay focused, not perfect

Step 1: Find the right competitors (5 min)

- Search for your primary keywords on Google. Note who’s running search ads

- Ask internal teams which brands are often mentioned by leads/prospects

- Check G2, Capterra, or Clutch to find similar players by category

- Save company names, domains, and social handles

Step 2: Pull active ads (8 min)

- Use Meta Ads Library to review Facebook & Instagram campaigns

- Check Google Ads Transparency Center for paid search and display ads

- Scan the LinkedIn company page Activity tab for Sponsored posts

- Document:

- Headline, copy, CTA

- Visual format (video, carousel, static, UGC)

- Platform and date launched

Step 3: Analyze landing pages (7 min)

- Click through 2–3 live ads

- Screenshot and document:

- Headline, CTA placement, value prop

- Form friction and length

- Use of social proof or urgency

- Use BuiltWith to check for tracking pixels (Meta Pixel, GTM, Hotjar)

Step 4: Infer targeting logic (5 min)

- Review language for segment clues (job title, industry, funnel stage)

- Note the awareness level (educational vs conversion-driven)

- Identify whether traffic is likely cold, warm, or retargeting

Step 5: Spot strategic patterns (5 min)

- Highlight ads running for multiple months (signal of success)

- Look for repeated messaging or formats

- Note any gaps — missing funnel stages, broken messaging, or poor copy

- Check Google/SpyFu for consistent paid keywords or bid history

FAQ

How is a marketing playbook different from a marketing plan?

What tools can I use to analyze competitor ads?

Can I build a performance marketing strategy without a big team?

How often should I update my marketing playbook?

Is copying competitor ads a good strategy?

Final thoughts

If you’ve made it this far, you’re already ahead of most teams.

By now, you’ve successfully learned how to reverse engineer your competitors’ paid strategies in just 30 minutes. This should help you not just to see what they’re doing, but to understand why it’s working (or not). Now, you can dissect their ads, map their funnels, spot key advertising mistakes, and learn how to extract repeatable lessons for your own growth.

Still, there’s a catch that most teams miss:

A marketing playbook on its own won’t grow your business.

Yes, it gives your team structure. Yes, it brings alignment and scalability. But what actually makes it work is your willingness to execute consistently and your investment in the right tools.

That means having the right set of tools to track your competitors that unsurface insights automatically, which previously you had to do manually. Consequently, these competitor ad intelligence tools ensure you to test fast and document even faster. As a result, your playbook stays alive and actionable, not theoretical

So take this reverse engineering method, run it once this week, and let it spark the first version of a smarter, sharper, more focused paid growth engine.

Your competitors are already writing their playbook in public.

Now it’s your turn to write one that actually wins.